The news the last couple of days has reported somewhat confusingly on new Chinese AI company called ‘DeepSeek’. I found a fairly clear report on the BBC about what is going on. DeepSeek itself isn’t the really big news, but rather what its use of low-cost processing technology might mean to the industry.

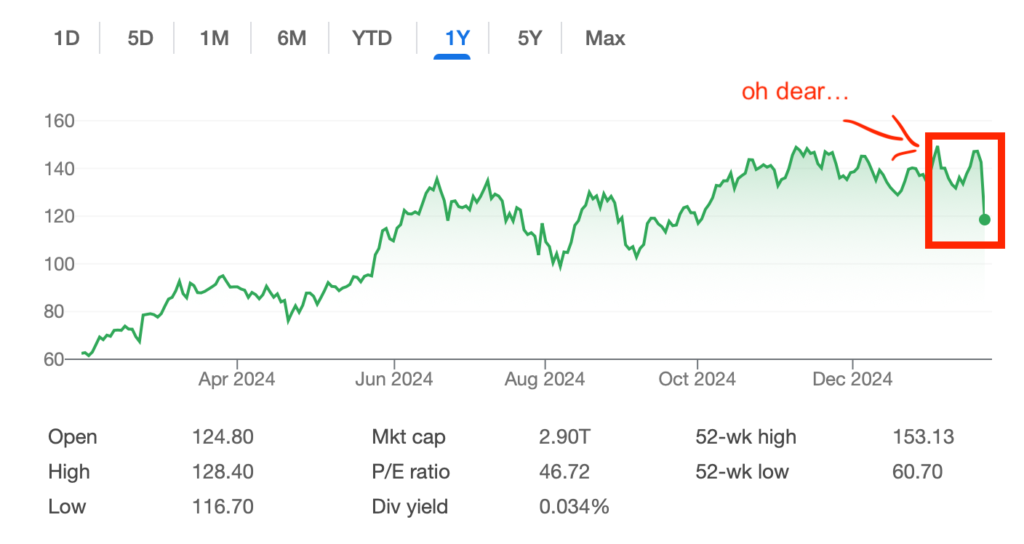

And that implication has cause a massive stock selloff of Nvidia resulting in a 17% loss in stock price for the company- $600 billion dollars in value decrease for that one company in a single day (Monday, Jan 27). That’s the biggest single day dollar-value loss for any company in U.S. stock market history.

I am not Nostradamus…

I speculated that there would be a market adjustment for Nvidia during 2025 in my predictions for the year, so hurray for me. I even pegged a decrease in value of at least 20% for the firm. I just didn’t expect 17% of that to occur in a single day.

My thinking was that the market would adjust based on realization that AI was not generating anything remotely close to the kinds of revenue needed to sustain the ten-fold growth in value of its largest hardware provider. That is the kind of realization that seems to take the bright sparks that drive stock market valuations quite a long time to figure out.

Instead another company came along that seems to (?) have produced good AI results with much cheaper hardware than Nvidia is currently selling. I hadn’t really seen that kind of change as being a primary driver for a market adjustment, but I guess that works too.

It is likely to turn out that DeepSeek isn’t all it is cracked up to be, and I expect Nvidia will recapture at least some of its initial single-day loss over the next few weeks. I still feel that my prediction for a >20% value decrease for Nvidia during 2025 is on the right track, but I feel it should play out over a more reasonable span of time.

Insane (to me) valuation

I still am amazed that Nvidia increased in value to over $3.5 trillion from under $500 billion five years ago riding high on a tsunami of AI hopes and dreams. They have been the most valuable company in the world for some time now, but today’s $600 billion drop puts them back in third place. That still seems crazy for a company that was on the verge of bankruptcy within my own personal memory.

Is Nvidia a good company? Absolutely: I’d call its choice to expand beyond graphics processing by putting resources into CUDA in the early 2000’s and focus on parallel processing a brilliant move. I could even see them being worth a trillion dollars based on future AI and parallel processing growth expectations.

But there are aspects of the stock market that defy rational thinking, and apparently the market thought they were worth $3.5 trillion… until today. I could be surprised and Nvidia could rise even higher than before later in 2025. I’ll just have to check my annual predictions at the end of the year and see if I was anywhere near being right.

They’ll always have crypto… or something…

Crypto- geez, I’d almost forgotten about that use for GPU processors, and that was a huge thing just a handful of years ago.

Parallel processing in general is a big deal, and CUDA-like GPUs are great for that whole category of workload. That includes protein mapping, weather forecasting, nuclear device calculations, cryptocurrency mining (thanks for reminding me, Wilhelm!), and of course AI model generation. AI is not going away, and I doubt very much that Nvidia will lose its dominance in the overall market any time soon. It just seems rational to me, however, that the lack of AI revenue should start to take some of the sparkle off.

But it is the stock market, so who knows what the heck is going to happen?